The economy of People's Republic of China (PRC) is facing headwinds for the remainder of 2023 that should continue into 2024 even though officials are exploring various stimulus efforts. The headwinds will impact consumption, production, and trade for both pork and beef. FAS China forecasts beef imports will decline in 2024 owing to flat demand and forecasts that pork imports for 2024 will remain relatively flat. Live cattle imports in 2024 are forecast to grow as Myanmar received official market access in July 2023.

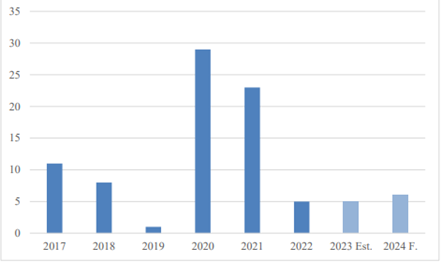

Swine Imports: Live swine imports in 2024 are forecast to grow from 5,000 to 6,000 head with industry interest in herd expansion.

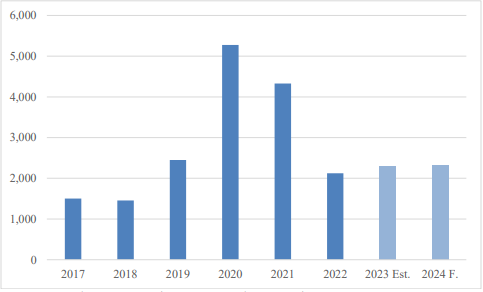

Pork Imports: Pork imports in 2024 are expected to stay at similar levels as recorded in 2022 and 2023.

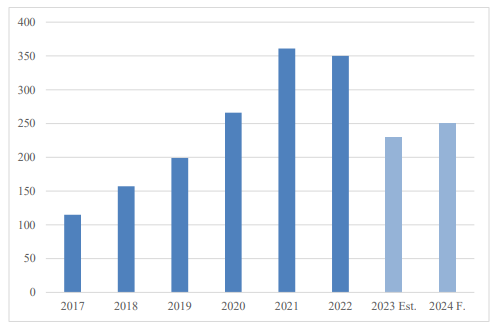

Cattle Imports: Cattle imports in 2024 are forecast to grow to 250 thousand head from the estimated 230 thousand head in 2023 owing partially to Myanmar's new market access for beef cattle for slaughter. However, price pressure on domestic dairy and beef cattle is expected to curb interest by industry members to expand the livestock herd and could soften demand for imported cattle for breeding purposes.

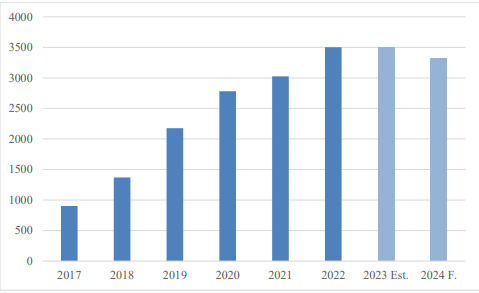

Beef Imports: Imports of beef for 2024 are forecast to decline to 3.32 MMT due to financial challenges facing importers, flat consumer demand, and higher production. Lower-priced grassfed beef will continue to dominate the import market.

SWINE

Live Swine Imports to Remain Low

In 2024, swine imports are forecast to grow from 5,000 to 6,000 head. This remains low in comparison with previous years (see CHART 1). Imported live swine are mainly for breeding purposes and are a tool to improve domestic herd genetics. The 2024 swine and sow inventory is expected to continue falling. If market conditions allow, industry members anticipate some producers will import swine to support another herd expansion even though current levels are above PRC official targets. In 2024, the major live swine suppliers are expected to remain the United States, France, and Denmark.

Chart 1. China: Live Swine Imports (Unit: 1,000 Head)

Source: Trade Data Monitor, LLC and Post Estimates

PORK

Pork Imports Stabilizing

Pork imports in 2024 are expected to grow to 2.32 MMT due to lower domestic production. Since China’s pork production has recovered to the pre-ASF level of around 55 MMT in 2022 and 2023, pork imports have declined to 2.1-2.3 MMT (see CHART 2). Spain, Brazil, Denmark, the Netherlands, Canada, and the United States are expected to remain the PRC's major pork suppliers.

Pork imports in 2023 are estimated at 2.3 MMT with 8 percent growth YOY. The HRI sector continues recovering following the easing of the PRC's zero-COVID controls. Though there were wide-scale lockdowns in 2022 making a YOY comparison difficult, pork imports during the first 5 months of 2023 increased by more than 20 percent from the same period last year. Imports in the second half of 2023 could slow with weak domestic pork prices, sluggish economic activity, and reportedly higher inventories of imported pork.

In May 2023, the General Administration of Customs of the People's Republic of China (GACC) announced that French-origin cured pork products meeting PRC requirements will be allowed for import into China. This enables the PRC to diversify suppliers of cured pork products outside of Spain. However, the import volume of cured pork products is minimal compared to frozen pork and a relatively minor part of total pork import volumes.

Chart 2. China: Imports of Pork Products (Unit: 1,000 MT)

Source: Trade Data Monitor, LLC and Post estimates

CATTLE

Cattle Imports to Grow

Cattle imports in 2024 are forecast to grow to 250 thousand head from the estimated 230 thousand head in 2023 (see CHART 3). The growth will mainly come from Myanmar. On July 14, 2023, GACC announced a change in the status of the foot and mouth disease situation and removed the ban on cattle from some areas of Guigai Township in the northern Shan State of Myanmar. The imported beef cattle from Myanmar will mainly be for slaughter use though coming into regulatory compliance and establishing export facilities may mean that Myanmar’s export numbers do not reach capacity in 2024.

In 2024, the import of live cattle for breeding purpose is forecast to decline. Australia, Uruguay, and Chile remain the PRC's major suppliers for live cattle for breeding purpose. Australia mostly exports dairy cattle while Uruguay and Chile mainly export beef cattle. Breeders are becoming less motivated to use imported cattle to improve the herd genetics as dairy and beef cattle prices decline. Also, New Zealand has ceased export of livestock by sea since April 2023, which has lowered the supply of available cattle imports. As the market cycles of both beef cattle and dairy cattle exist in China, the import of live breeding cattle for dual purposes could become a tool for managing market fluctuations.

Chart 3. China: Live Cattle Imports (Unit: 1,000 Head)

Source: Trade Data Monitor, LLC and Post Estimates

BEEF

Beef Imports Likely to Decline

In 2024, beef imports are forecast to decline by 5 percent to 3.32 MMT (see CHART 4) as importers' financial challenges continue and flat demand persists. Sources suggest it is unlikely for importers to stock as much in 2024 as they did in the first half of 2023 when imports prices were lower. As of July 2023, the beef inventory in importers' warehouses, including the inventory carried over from 2022, is high. In order to recoup some of their investment, importers are selling below cost which is putting some beef importers in difficult financial situations.

With flat demand and an expected increase in domestic production in 2024, the supply gap needing to be filled by imported beef is smaller. Lower-priced grass-fed beef imported from Brazil, Argentina, and Uruguay will continue to dominate the import market and these beef products are expected to be used in food processing facilities, lower-end restaurants, and canteens (i.e., institutional establishments).

There remains a market for beef imported from the United States, New Zealand, and Australia. Compared to South American beef, the beef quality from the three countries is perceived better and the supply is considered more stable. These beef products are typically served in retail and higher-end restaurants. Although some western-style food restaurants have started to show more interest on beef imported from Uruguay and Argentina, chilled beef from the United States, Australia, and New Zealand remains a high-end niche market product.

Chart 4. China: Beef Imports (Unit: 1,000 MT)

Source: Trade Data Monitor, LLC and Post Estimates

Please click the link below to access the report.

Link:static/file/Livestock and Products Annual_Beijing_China - People's Republic of_CH2023-0111.pdf

Source: USDA

Note: This article is compiled by Antion. Please indicate the source for reprint.