FAO Food Price Index

The FAO Food Price Index is a measure of the monthly change in international prices of a basket of food commodities. It consists of the average of five commodity group price indices, weighted with the average export shares of each of the groups for 2002-2004.

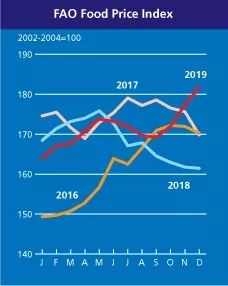

The FAO Food Price Index soared to a 5-year high in December

The FAO Food Price Index* (FFPI) averaged 181.7 points in December 2019, up 4.4 points (2.5 percent) from November, marking the third month of consecutive increase. Strong rallies in vegetable oils, sugar and dairy markets pushed up the overall value of the Index to its highest level since December 2014. However, for 2019 as a whole, the FFPI averaged 171.5 points, only 3 points (1.8 percent) higher than in 2018 and still significantly (58 points or 25 percent) below its peak of 230 points registered in 2011.

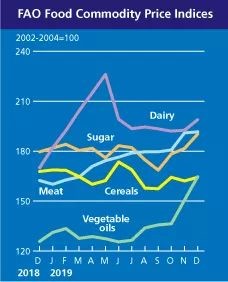

FAO Cereal Price Index averaged almost 164.3 points in December, representing a rebound of 2.2 points (1.4 percent) from November. The rise in December was largely led by higher international prices of wheat, as import demand from China accelerated while logistical problems in France, due to continued protests and worries over growing conditions in several important regions, also provided support. In coarse grain markets, most price quotations were generally around the same levels as in the previous month, with maize prices rising only slightly due to harvesting pressure and slow trade activity. FAO's all rice price index changed little in December, as seasonal declines in fragrant quotations outweighed gains in the Indica segment, where supply constraints provided some support to prices. Reflecting overall good supply conditions, the FAO Cereal Price Index averaged 164.4 points in 2019, down marginally (by 0.9 points) from its 2018 annual average.

The FAO Vegetable Oil Price Index averaged 164.7 points in December, up 14.1 points (9.4 percent) from November and reaching a 25-month high. The latest upturn was primarily driven by firming palm oil prices, while soy, sunflower and rapeseed oil values also increased. International palm oil prices rose for the fifth consecutive month on solid demand, especially from the biodiesel sector, coinciding with prospects of tightening supplies. Further to the positive effect from rising palm oil values, the prices of soy, sunflower and rapeseed oils also responded to, respectively, reduced crushing volumes in major producing countries, firm global import demand, and concerns over tightening world supplies. Notwithstanding the strong rebound in prices since November, for 2019 as a whole, FAO’s Vegetable Oil Price Index averaged 135.2 points, down 8.9 points from 2018 and marking the lowest annual average since 2006.

The FAO Dairy Price Index averaged 198.9 points in December, up 6.3 points (3.3 percent) from November. Cheese price quotations surged the most, rising by almost 8 percent following three months of continuous decline, underpinned by strong global import demand amidst tighter export availabilities from the European Union and Oceania. After a sharp increase already in November, quotations for skim milk powder (SMP) continued to point higher in December, supported by limited availability of spot supplies, especially from the European Union. By contrast, weak global demand resulted in lower butter and whole milk powder (WMP) values. For 2019 as a whole, the FAO Dairy Price Index averaged nearly 199 points, up 5.8 points (3.0 percent) from 2018, with SMP prices registering the sharpest year-on-year increase, followed by cheese and WMP, while butter values averaged lower.

The FAO Meat Price Index* averaged 191.6 points in December, almost unchanged from its revised November value. At this level, the index is 29 points (18 percent) above its corresponding month in 2018, though still well below (by 20.0 points) its peak reached in August 2014. In December, price quotations for pig meat rose as global market tightness continued with some major suppliers, especially the European Union and Brazil, struggling to keep pace with strong pre-festivity internal demand, in addition to persistent solid import demand from Asia. Quotations for ovine meat rose for the ninth consecutive month due to strong import demand amidst limited export supplies from Oceania, while those for poultry meat increased slightly on account of tighter supplies, especially from Brazil. By contrast, price quotations for bovine meat fell in view of the reduced purchases by China – the main source of demand for several months. Overall, the FAO Meat Price Index averaged 175.8 points in 2019, an increase of 9.5 points (5.7 percent) from 2018. Among the different meat categories, pig meat prices registered the biggest year-on-year increase, followed by bovine and poultry meat, while those of ovine meat averaged below their respective 2018 annual average.

The FAO Sugar Price Index averaged 190.3 points in December, up 8.7 points (4.8 percent) from November, marking the third consecutive monthly increase. The latest rally in international sugar price quotations was prompted by rising crude oil prices, a situation that encouraged Brazil’s sugar mills to use more sugarcane supplies to produce ethanol instead of sugar, which resulted in reduced sugar availability in the global market. However, continued weakness of the Brazilian Real against the United States Dollar, coupled with improved prospects for the sugar harvest in India, contained prices from rising even further. Overall, sugar prices in 2019 were up 1.6 percent from 2018, amid some tightening in the global supply and demand balance.

* Unlike for other commodity groups, most prices utilized in the calculation of the FAO Meat Price Index are not available when the FAO Food Price Index is computed and published; therefore, the value of the Meat Price Index for the most recent months is derived from a mixture of projected and observed prices. This can, at times, require significant revisions in the final value of the FAO Meat Price Index which could in turn influence the value of the FAO Food Price Index.