Functional nutrients are expected to be among the most influential trends in packaged food in the coming years. In consumers’ minds, nutrition is no longer the remit of medical professionals, but a component of lifestyles. More natural foods, and the natural nutritious benefits of ingredients, are sought.

The fast and broad “snackification” of foods – which sees an increasingly frequent consumption of food during the day – has resulted in people buying food with higher awareness of their impact on health.

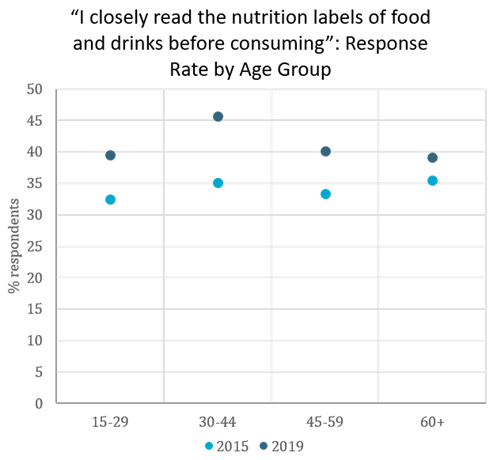

As an increasing number of people closely read nutrition labels, nutrient manipulation is less likely to be seen as a healthy way of making packaged food. Consumers are therefore shifting away from better-for-you foods to more holistically natural offerings where protein, fibre and minerals are intrinsically part of the ingredients. Gut and vision health in adults and brain development for young children are two areas presenting exciting potential for further innovation in nutrition.

Source: Euromonitor International Health and Nutrition Survey

The democratization of nutrition calls for more clean labels

In mature countries, monitoring nutrient content or intake through technology is increasingly part of the equation. Yuka, an app available in France, Benelux and the UK, reportedly scans 3 million barcodes a day – and similar solutions are likely to become ever-more commonplace.

Together with the rapid increase of wearables bought globally over 2014-2019, Euromonitor International’s consumer research surveys show consumers are increasingly tracking their health through devices and apps.

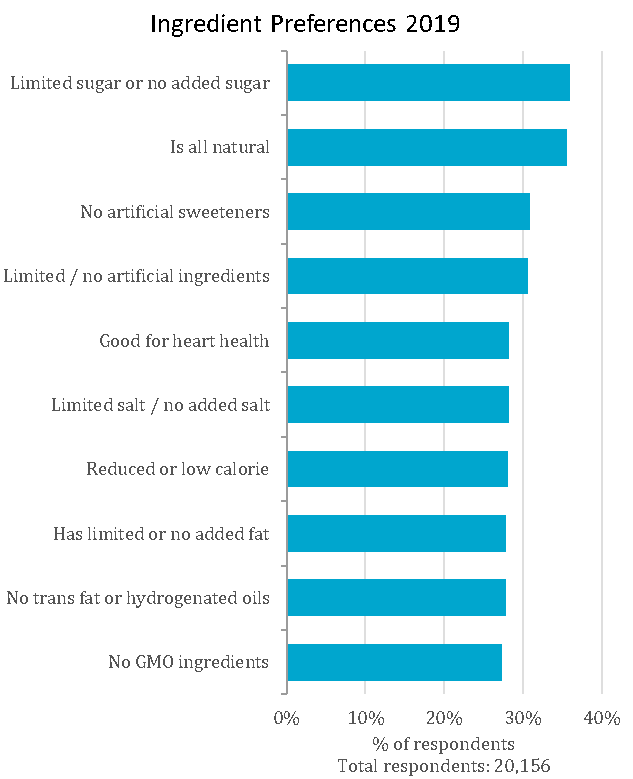

Both the search for more natural foods and the will to track nutrient intake will increase the importance of clean labels and the place of ingredients in a product’s positioning. “No artificial colours” labels bode well in dairy and ice cream while shoppers will be most responsive to “GMO-free” claims in snacks and baby food.

Source: Euromonitor International Health and Nutrition Survey

New value equation: only affordable nutrition can bridge the gap

Across many markets, the mid-priced segment has contracted in favour of more premium variants on the one hand, and more economic propositions on the other. Affordability is now a double-edged sword: being increasingly needed in order to reach the lowest-income bands, but not without the targeted nutritional benefits required to combat malnutrition and obesity.

Population growth, largely coming from developing countries, translates to the widening of the pool of low-income earners and price-sensitive consumers, and a narrowing of the middle-class. Malnutrition is a major issue in parts of Asia Pacific and the MEA. Food manufacturers need to address it by marrying nutritional value at a low price point. Biofortified crops such as vitamin A corn and cassava offer promising potential.

Among more mature markets, weakened consumer confidence should maintain momentum for discounters such as Lidl and Aldi in Western Europe. Greater value for money will also be achieved through a shorter supply chain and online delivery channels.