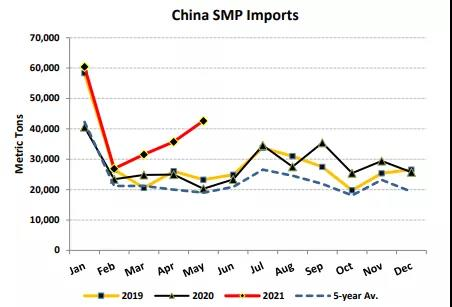

Global dairy prices are relatively strong due in large part to the unprecedented import demand for dairy products by China. This year, in the period from January through May, China’s imports of dairy products have grown by nearly 17 percent to reach $6.4 billion. There has been a surge in China’s import demand for a broad range of dairy products, notably fluid milk, milk powders, and whey and whey products. Perhaps most surprising has been the recent surge in imports of skimmed milk powder (SMP) which have departed from the traditional pattern of purchases. In the past, inflows of SMP were more pronounced in the first quarter due to the free trade agreements (FTAs) with New Zealand and Australia. Thereafter, they stabilized at around 20,000-30,000 tons per month for the balance of the year. This year, SMP imports are on a new trajectory having steadily climbed since February and are now up 50 percent through May in comparison to last year. China’s imports of SMP are now forecast to reach a record 480,000 tons.

Although U.S. dairy exporters have only captured a small portion of the China dairy import market that is dominated by the EU-28 and Oceania, it remains a critical market. It is currently ranked as the second-largest market on a volume basis for U.S. dairy exports after Mexico. This year, the volume of U.S. dairy exports to China through May is already up nearly 75 percent year-over-year. Shipments of U.S. SMP through this period are up nearly fivefold. But U.S. dairy exporters are also indirectly benefitting from China’s import demand as a result of the higher global dairy prices. They have also been able to take the opportunity to ship greater quantities of dairy products to relatively new markets such as Vietnam.

Fluid Milk:

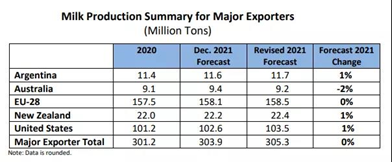

l The 2021 milk production forecast for Argentina is revised up 1 percent from the December forecast to 11.7 million tons. Milk output is off to a strong start during the first half of the year, with cumulative production January through May up 4 percent. However, production is expected to moderate as dairy farmers face an uncertain economic climate. The government has already imposed a number of price controls on dairy products, some of these controls for such products as butter, infant formula, grated cheese, etc., expired in June. The government’s objective is to control food price inflation by focusing on ensuring there is an adequate supply of products to the domestic market. The government has also threatened to introduce export controls. In March 2020, Argentina implemented an export tax of 5 percent on fluid milk and 9 percent on powdered milk.

l Consequently, farmers face relatively fixed prices for their products which coupled with rising input costs, particularly for feed, are expected to tighten margins. This especially have an adverse effect on the smaller dairy farmers. There is also the prospect of less pastureland as farmers plant land to crops such wheat, corn, and soybeans. As a result, milk production is expected to slow modestly in late 2021 but will nevertheless be up by 3 percent over 2020.

CHEESE:

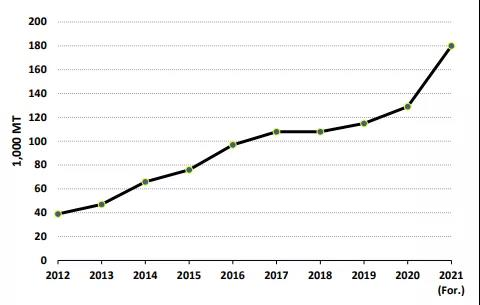

l The cheese import forecast for China is raised by 38 percent to a record 180,000 tons as the domestic market continues to expand at an unprecedented rate. Imports of cheese this year through May are up by two-thirds compared to the same period last year. Since 2012 through 2020, annual import demand has grown at an average annual rate of 16 percent. China is now expected to be the largest import market for cheese in the world surpassing the United States. The bulk of the market is supplied by New Zealand and the EU-28 accounting for 56 percent and 21 percent of the import market, respectively.

China Cheese Imports

SKIMMED MILK POWDER (SMP):

SMP Exports Summary for Major Exporters

(1,000 Tons)

WHOLE MILK POWDER (WMP):

WMP Exports Summary for Major Exporters

(1,000 Tons)

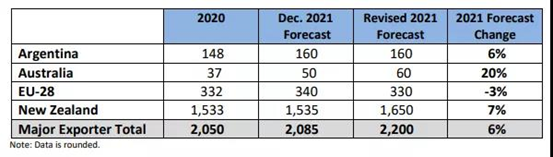

l China is rebounding after the negative impact of the COVID-19 pandemic and economic growth (real GDP) growth is forecast at about 8 percent for this year. This has led to a surge in imports of WMP with to-date imports through May up 23 percent compared to the same period last year. Given this strength and the continued expectation of economic growth the import forecast is revised up 15 percent to 825,000 tons. Most of the WMP supply will originate from New Zealand which has a free trade agreement with China. This allows for all New Zealand dairy products to enter China duty-free.

l New Zealand shipments of WMP have been booming with exports averaging about 145,000 tons per month this year through May. This is 10 percent higher compared to the same period last year. Given the strong import demand from China and higher expected milk production, the export forecast is revised up to 1.65 million tons. In 2020, approximately 43 percent of WMP shipments were destined to China. This year through May, a similar percentage is also flowing to China.

Please click the link below to access the report: