On November 30, 2020, China International Import Expo released the China Dairy Products Import Situation Report, which is divided into two parts, the first part is the illustration of the overall import situation of dairy products in China, and the last part is the introduction of the import situation of different categories of dairy products. This time, we will illustrate the import situation of different categories of dairy products.

The Import Situation of Different Categories of Dairy Products

Retail packaged infant formula milk powder

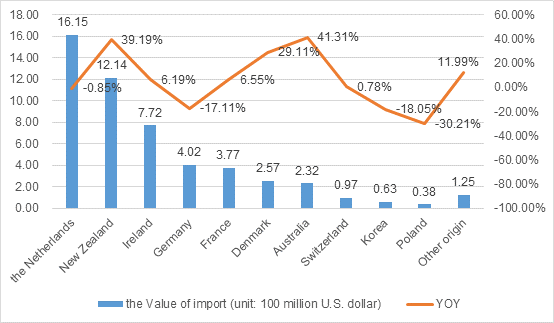

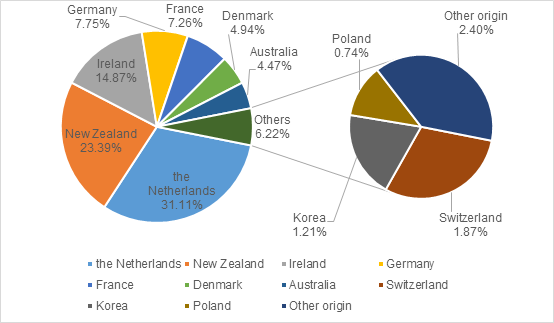

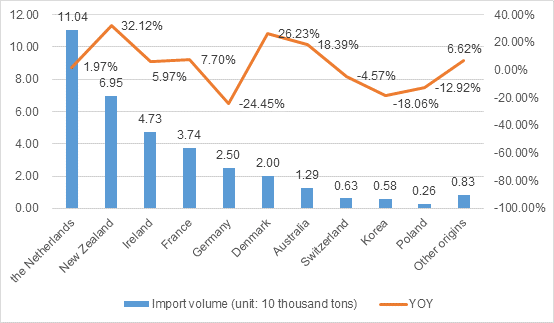

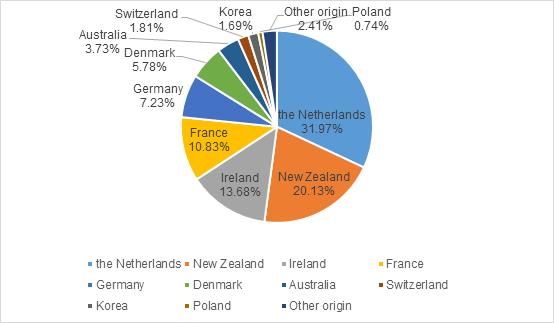

In 2019, among the sources of imported retail packaged infant formula milk powder in China, the top three by the value of import are the Netherlands, New Zealand and Ireland. There are 110 thousand tons of retail packaged infant formula milk powder from the Netherlands with value of $1.61 billion, 7 thousand tons from New Zealand with value of $1.21 billion, and 47 thousand tons from Ireland with value of $0.77 billion.

Figure 1: The value of import for retail packaged infant formula milk powder by origin in 2019 and year-on-year

Figure 2: The proportion of the value of import for retail packaged infant formula milk powder by origin in 2019

Figure 3: The import volume of retail packaged infant formula milk powder by origin in 2019 and year-on-year

Figure 4: The proportion of import value of retail packaged infant formula milk powder by origin in 2019

Whole milk powder

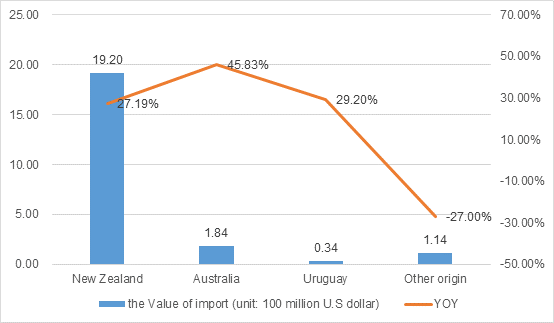

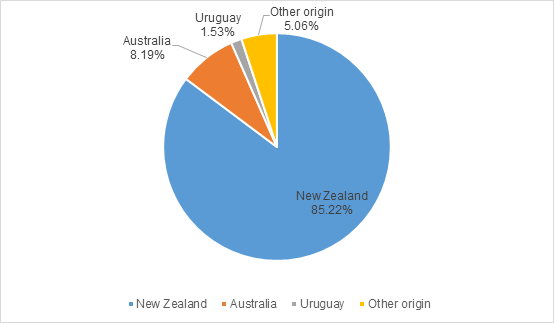

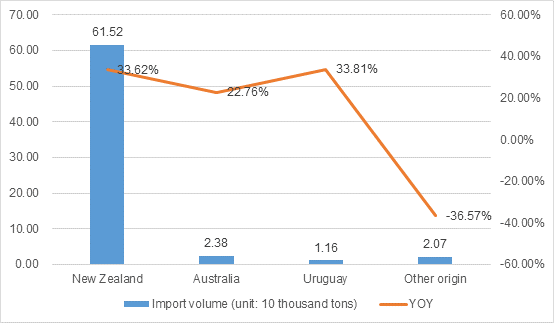

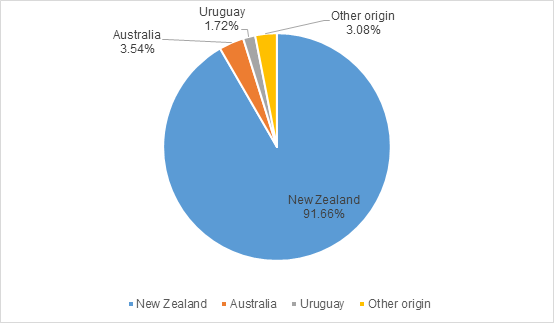

In 2019, among the sources of imported whole milk powder in China, the top three by the value of import are New Zealand, Australia and Uruguay. There are 0.615 million tons of whole milk powder from New Zealand with value of $1.92 billion, 24 thousand tons from Australia with value of $0.18 billion, and 12 thousand tons from Uruguay with value of $30 million.

Figure 5: The value of import for whole milk powder by origin in 2019 and year-on-year

Figure 6: The proportion of the value of import for whole milk powder by origin in 2019

Figure 7: The import volume of whole milk powder by origin in 2019 and year-on-year

Figure 8: The proportion of import value of whole milk powder by origin in 2019

Skimmed milk powder

In 2019, among the sources of imported skimmed milk powder in China, the top three by the value of import are New Zealand, Australia and Germany. There are 140 thousand tons of skimmed milk powder from New Zealand with value of $0.34 billion, 44 thousand tons from Australia with value of $0.15 billion, and 29 thousand tons from Germany with value of $70 million.

Figure 9: The value of import for skimmed milk powder by origin in 2019 and year-on-year

Figure 10: The proportion of the value of import for skimmed milk powder by origin in 2019

Figure 11: The import volume of skimmed milk powder by origin in 2019 and year-on-year

Figure 12: The proportion of import value of skimmed milk powder by origin in 2019

Milk

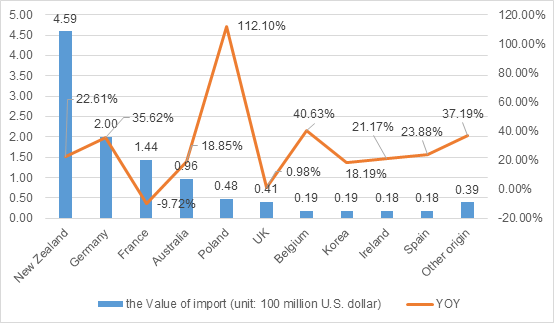

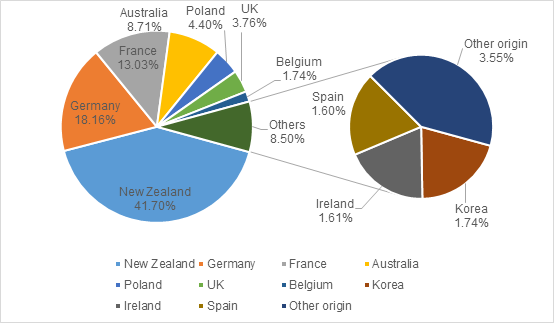

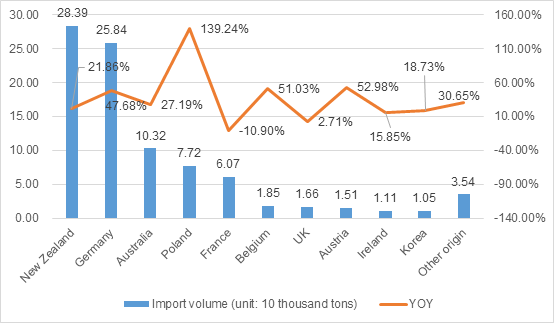

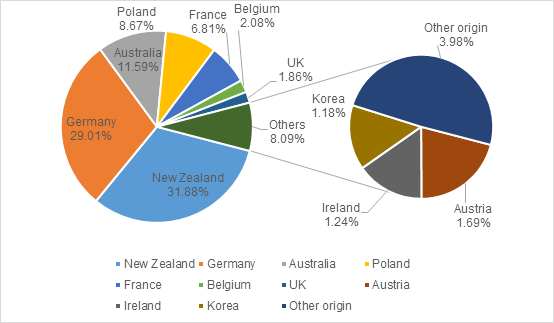

In 2019, among the sources of imported milk in China, the top three by the value of import are New Zealand, Germany and France. There are 0.284 million tons of milk from New Zealand with value of $0.46 billion, 0.258 million tons from Germany with value of $0.2 billion, and 61 thousand tons from France with value of $0.14 billion.

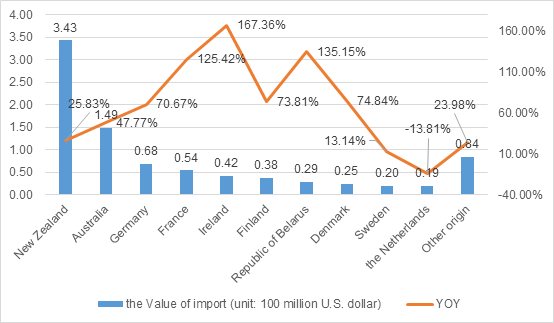

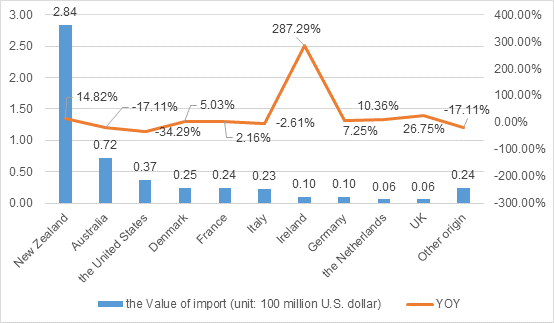

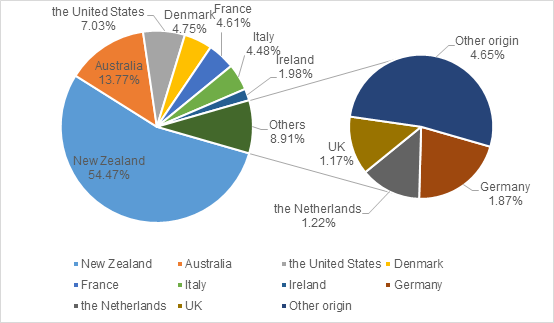

Figure 13: The value of import for milk by origin in 2019 and year-on-year

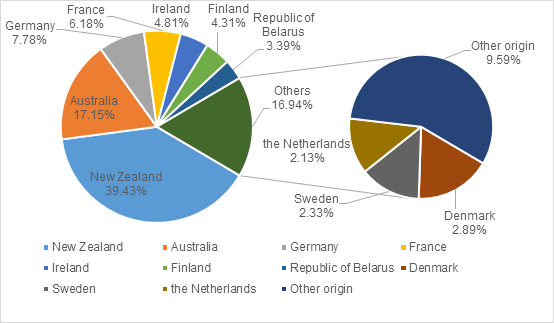

Figure 14: The proportion of the value of import for milk by origin in 2019

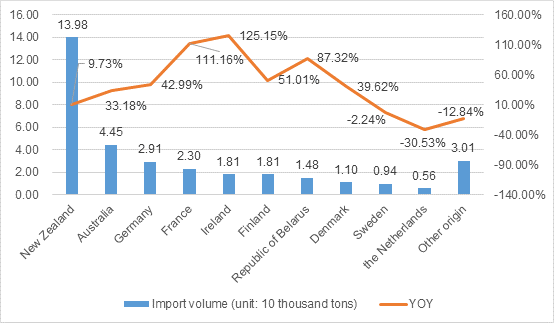

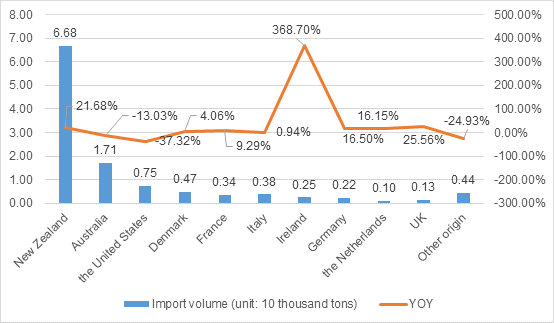

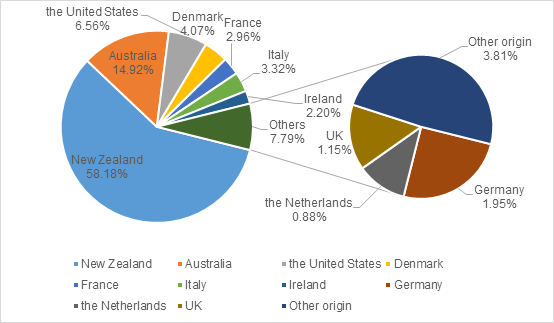

Figure 15: The import volume of milk by origin in 2019 and year-on-year

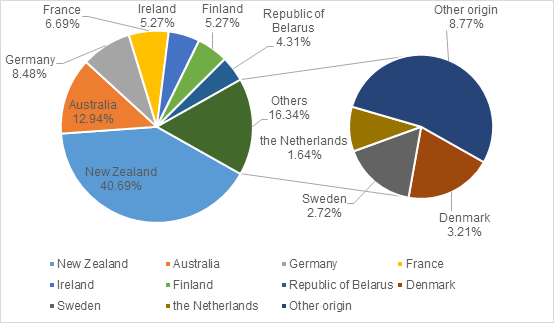

Figure 16: The proportion of import value of milk by origin in 2019

Cheese

In 2019, among the sources of imported Cheese in China, the top three by the value of import are New Zealand, Australia and the United States. There are 67 thousand tons of Cheese from New Zealand with value of $0.28 billion, 17 thousand tons from Australia with value of $70 million, and 8 thousand tons from the United States with value of $40 million.

Figure 17: The value of import for cheese by origin in 2019 and year-on-year

Figure 18: The proportion of the value of import for cheese by origin in 2019

Figure 19: The import volume of cheese by origin in 2019 and year-on-year

Figure 20: The proportion of import value of cheese by origin in 2019

Butter

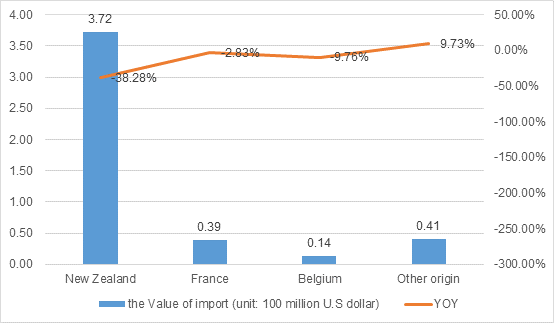

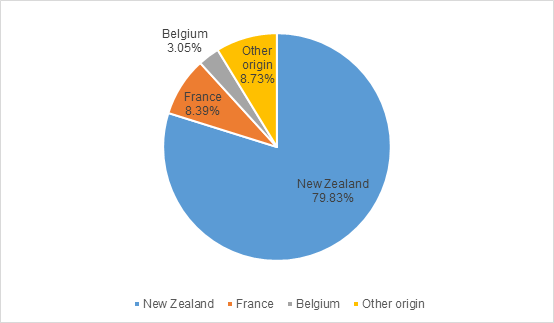

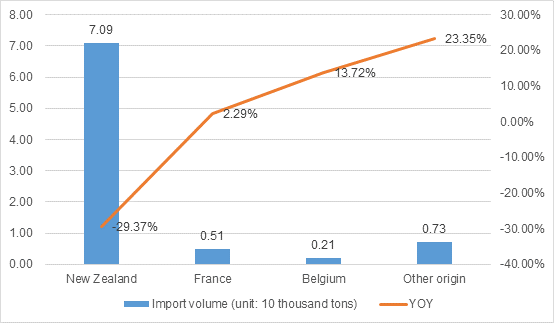

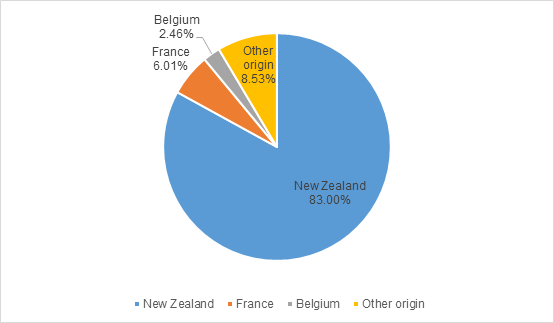

In 2019, among the sources of imported butter in China, the top three by the value of import are New Zealand, France and Belgium. There are 71 thousand tons of butter from New Zealand with value of $0.37 billion, 5 thousand tons from France with value of $40 million, and 2 thousand tons from Belgium with value of $10 million.

Figure 21: The value of import for butter by origin in 2019 and year-on-year

Figure 22: The proportion of the value of import for butter by origin in 2019

Figure 23: The import volume of butter by origin in 2019 and year-on-year

Figure 24: The proportion of import value of butter by origin in 2019

With the increase in consumption level and changes in consumption structure, the continued rapid growth of dairy imports will provide a broader market opportunity for Chinese and foreign dairy enterprises, and will also promote a more open, freer, fairer and more convenient global dairy trade system.

More information about the first part of the Report please click CIIE Released the China Dairy Products Import Situation Report