In 2022, China’s hog production is forecast to decline by 5 percent. Low prices and disease outbreaks in 2021 led to significant slaughter and delayed restocking. Pork production in 2022 will decline by 14 percent as fewer hogs come to market and government policies designed to limit price fluctuations inadvertently undermine expansion. Pork imports will rise to 5.1 million MT as consumer demand for pork exceeds domestic production. Cattle and beef production will grow slowly in 2022. High beef prices will encourage investments by large producers. However, small producers with poor herd genetics and space constraints will continue to dominate production. Cattle imports will be stable at 350,000 head. Beef imports will grow to reach 3.3 million MT, but at a slower rate, as high beef prices are balanced by more diverse beef suppliers entering the market.

Hog Imports: Imports of live breeding swine in 2022 will decline by 14 percent to 30,000 head as pork price management by China’s regulatory and planning agencies tempers expansion. However, other policies to develop China’s domestic genetics production and improve overall sow productivity will ensure that imports of live breeding swine do not sharply decline.

Pork Imports: In 2022, a tight pork supply will drive pork imports to reach 5.1 million MT (MMT). In 2021, significant slaughter increased pork production and frozen pork reserves. Higher consumer and institutional demand in the fall and winter months of 2021 will deplete frozen pork reserves. For this reason, pork imports are forecast to rise in 2022 as pork supplies tighten.

Cattle Imports: Imports of live cattle will remain stable in 2022, with beef cattle increasingly occupying a greater proportion of total imports. Dairy cattle imports are expected to decline in 2022.

Beef Imports: In 2022, imports of beef will reach 3.3 MMT driven by consumer demand and limited domestic supply. However high beef prices will temper more significant growth.

Imports of breeding swine expected to decline by 14 percent, but remain historically high

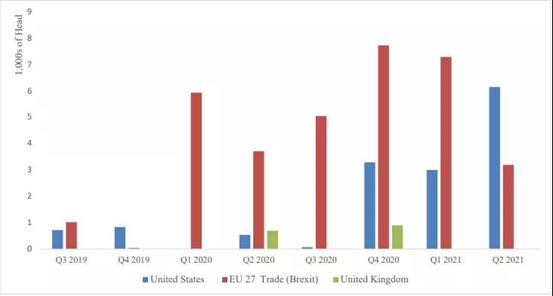

In 2022, imports of breeding swine, primarily sows, are expected to decline by 14 percent to 30,000 head. Low pork prices in 2021 and losses for hog operations across the sector will temper optimism for aggressive expansion (see Chart 3). Furthermore, those producers and provincial governments that invested in breeding swine in 2020 and 2021 will focus resources on commercializing these investments. Industry sources indicate that imported genetics usually take between 3 to 5 years to be ready for widescale commercial distribution. The United States, the European Union and the United Kingdom are expected to remain the top three suppliers of breeding swine to China. In 2022, new quarantine facilities which were approved in 2021 should provide sufficient capacity for imports, but certain testing requirements will be an impediment for additional increases in the import of U.S. breeding swine.

Chart 3. China: Quarterly Imports of Live Swine by Supplier to China

Source: TDM

Imports to reach 5.1 MMT following decline in domestic pork supply

Imports of pork are forecast to reach 5.1 MMT in 2022 due to limited domestic pork supplies. China’s domestic pork price controls may reduce the price advantage of imported products, but consumers demand drive purchases of imported pork products. In 2022, consumers will continue to expand the use of e-commerce platforms for at home purchases. Imported meat products will utilize these channels to expand sales and amplify consumer awareness of branded or specialty products.

E-commerce and food service an opportunity for growth for imported pork products

In 2022, the volume of imported pork products sold through e-commerce platforms will increase as this new distribution channel supports growth and product differentiation for imports. Popular imported cuts include pork neck, bone-in-ham, and leg/ham hocks, among others. The use of imported frozen pork in food service and food processing sectors will also increase due to limited domestic pork supplies.

Logistics costs, disruptions and COVID-19 testing expected to improve in 2022

In 2022, international shipping and port issues caused by the COVID-19 pandemic are expected to improve. In 2020 and 2021, lack of vessel cargo space and shortages in refrigerated containers for chilled and frozen products caused widescale supply chain disruptions and significantly increased costs. In 2022, importers of cold-chain products, especially meat and aquatic products, may be faced with increased COVID-19 testing, disinfection, and inspection requirements (see above). These changes will require importers, ports and clearing officials to adapt. However, adjustments to changes will likely cause added costs and delays for imported products.

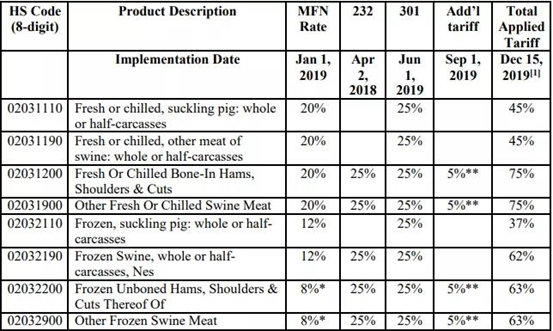

China's retaliatory tariffs on U.S. products

China maintains retaliatory Section 232 and Section 301 tariffs on to U.S. pork products, amongst other U.S. agricultural goods. China's retaliatory Section 232 tariffs, which account for an additional 25 percent tariff on certain pork products, do not qualify for tariff exclusions (see the Tariff Schedule for U.S. Pork Products below for additional details).

On February 18, 2020, the State Council Tariff Commission (SCTC) announced a tariff exclusion process for U.S. agricultural commodities impacted by the retaliatory Section 301-tariffs levied by China. Importers may apply for tariff exclusions which are approved on a case-by-case basis. These exclusions do not automatically extend to all importers. Please refer to FAS GAIN report Updated Guidance on China's Retaliatory Tariffs and Tariff Exclusions Process for US Products for more information on the exclusion process.

Many pork importers have applied and received tariff exclusions. Previously, on February 6, 2020, SCCTC reduced the additional Section 301 tariffs on certain commodities, including all pork products. This reduction was effective from February 14, 2020.

Table 3. China: Tariff Schedule on U.S. Pork Products

Note: * Tentative tariffs effective on January 1, 2020. **Additional tariffs were adjusted on February 14, 2020 and additional exclusions granted March 2, 2020

Imports to remain stable at 350,000 head of cattle

In 2022, imports of live cattle to China will remain stable at 350,000 head. In 2022, China’s import of Uruguayan cattle, primarily beef cattle, is forecast to remain strong. However, imports of New Zealand cattle, primarily dairy cattle, will decline. This decline will be due to weaker demand for dairy cattle and a reported ban on live cattle exports by New Zealand (to be fully implemented by 2023).

Bovine semen imports expected to reach U.S. $75 million (*not included in PSD)

In 2022, bovine semen imports are expected to reach U.S. $75 million - dominated by U.S. bovine semen. China has not permitted the import of live cattle from the United States. Imports of bovine semen allow China’s cattle producers to introduce U.S. genetics into their herds. The United States, Australia and the European Union are the dominant suppliers of bovine semen to China.

Imports in 2022 projected to increase to 3.3 MMT, but slowing growth from 2021

In 2022, imported beef is expected to reach 3.3 MMT, a 6 percent growth over 2021 with more diverse import suppliers. The growth rate of imports in 2022 is expected to slow, following dramatic growth in 2020 and 2021. Imported beef consumption will be driven by consumer demand in retail, HRI, and income growth in second and third tier cities. However, the price of beef compared to other domestically consumed animal proteins will be a limiting factor for consumption by households across a broad range of economic levels.

In 2022, imports of beef from Argentina, a major supplier, are expected to resume following the termination of an export ban by the end of 2021. 8 Dominant suppliers are expected to face competition as China focuses on diversifying import partners.

8 Argentina instituted a beef export ban in May 2021, other suppliers are expected to absorb some of this market share as China’s demand for beef imports continues to be strong.

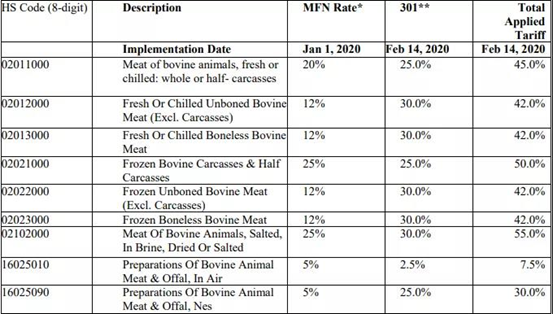

China's retaliatory tariffs on U.S. products

China maintains Section 301 retaliatory tariffs on U.S. beef products. Similar to pork products, importers may apply for tariff exclusions which are approved on a case-by-case basis. These exclusions do not automatically extend to all importers. Please refer to FAS GAIN report Updated Guidance on China's Retaliatory Tariffs and Tariff Exclusions Process for US Products for more information on the exclusion process. This reduction was effective from February 14, 2020 (see the Tariff Schedule for U.S. Beef Products below).

Table 6. China: Tariff Schedule on U.S. Beef Products

Note: * Tentative tariffs effective on January 1, 2020. **Additional tariffs were adjusted on February 14, 2020 and additional exclusions granted March 2, 2020

Please click the link below to access the report.

static/file/Livestock and Products Annual_Beijing_China - People's Republic of_08-15-2021.pdf

Source: FAS

Note: This article is compiled by Antion, please indicate our source if reprint it.